First, I want to follow up the title of “We’re debt free!” with the most important phrase of this post: to God be the glory! Eugene & I are so happy to share that we are debt free, other than our house mortgage!

Honestly, this is awkward for me to share , but I’m doing it in hopes that it might encourage someone who is aiming for debt-free too. {If that’s you, press on! You can do it too!}

How about we start with the facts, the cold-hard numbers:

I graduated college 5 years ago, Eugene 3.5. He had a little less debt than I did, but we were pretty close in amounts. I paid a few small loans off before we were married, but after the wedding, we combined accounts and incomes.

- $48,125 – our grand total original balance

- $58,589 – total paid because of earned interest {how crazy is it that in just 5 years, our loans increased $10k…yuck! More motivation to pay ‘em off quickly!}

In four years of saving through college and five years of working full-time, we’ve worked to pay off almost $60k, and to God be the glory! I know a lot of people have much higher college loans, but I’m pretty proud of managing that much in only 5 years with being laid off, working starter salaries, buying a house, putting probably close to $30k cash into it {if not more}, having a baby, etc. In that last year, Eugene & I got really focused on the goal of paying these loans off. Just from August of last year to today, we paid over $38,000 towards our debt. That means that we were basically living off only one of our incomes for a year, while applying the other completely to our loans!

God is pretty awesome in the details of it all. One small example of this – for instance, we thought we had another 6 months before paying it off, but I got a bonus type of payment this month that was almost the exact amount still owed. God’s so cool.

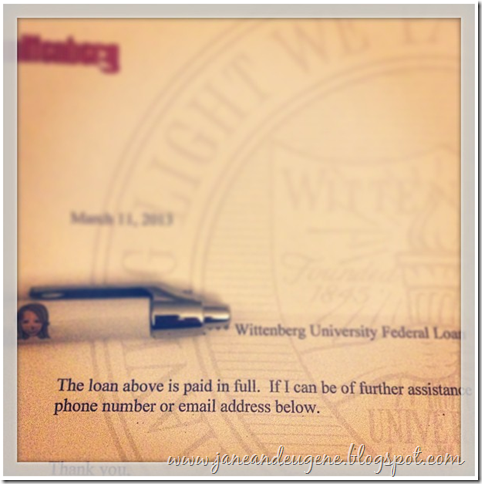

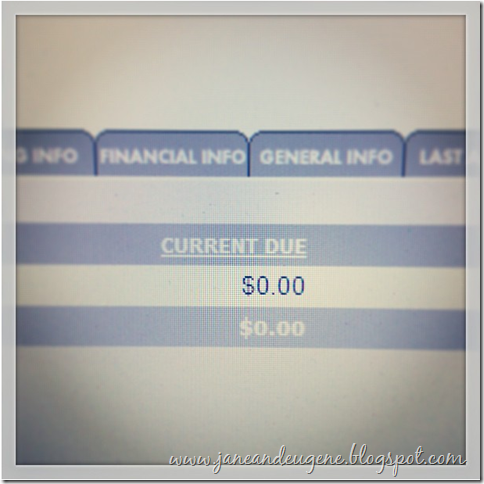

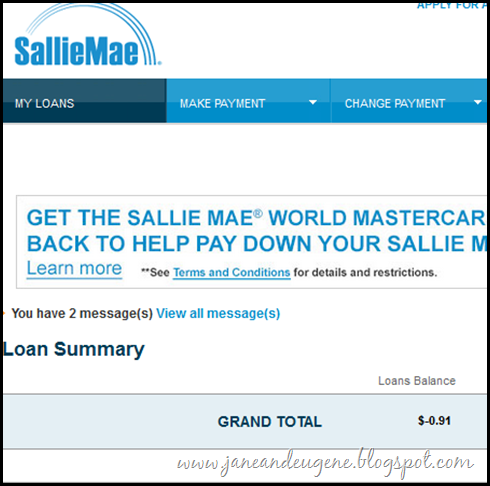

Check this out: good ol’ Sallie Mae actually owes me! How stinkin’ fantastic is that irony!?

To a lot of people, this is probably no big deal, but to me, it’s HUGE. I’m a little leery to share all this, mainly because I don’t want it to sound like I’m bragging. This is not my doing, none of it. I will boast in the Lord. It’s purely God being the great Jehovah Jireh once again. {PS that’s my favorite name of God. You can probably guess why. :)}

I’ve mentioned our goal to pay off our college loans numerous times on this blog {here about house purchases, here when we first looked at buying a house, here when I had to keep learning how to trust God with my future, here about 2 Corinthians-type of hardships}, but I haven’t really gone into details of my personal journey with debt.I guess now is an appropriate time to share with you.

My biggest source of struggle in life - with doubt and disbelief, anger, hatred {you name it} - has always been directly tied to my large amount of college debt. I chose to attend a very expensive private college. Many, maybe even most, of my classmates didn’t have to worry about college costs thanks to their parents’ or scholarships covering their tuition {usually the former}; however, I knew going into my first day at college that I’d be bearing the full weight of any expenses from my four years at college. I volunteered a lot in high school and got solid grades which garnered me a decent scholarship, but I was still looking at a big chunk of change due for each semester.

I took out the usual college loans: the dreaded Sallie Mae, federal loans, and private loans. I met with someone in the financial aid office at least once every semester, asking if there were any unclaimed scholarship funds that I could get {surprisingly, this occasionally got me additional “free” money through small local scholarships that no one applied for.} But after every routine meeting with a financial aid officer, I distinctly remember walking to a particular secluded set of steps on campus and just flat-out bawling my eyes out at the thought of my increasing debt. I felt completely weighed down and constantly enslaved to the debt…worst feeling ever. I really struggled under the burden of knowing I owe so much money for at least 30 years after graduating. I also struggled with the whole convoluted system of needing to go deep into debt to make decent money.

As a side note, it’s important that I mention here that I don’t regret my college choice. I prayed about my choice. I priced out state schools too, and because my community service scholarship and FAFSA, which provides financial assistance according to your parents’ income {which is a total crock if you’re parents aren’t paying for you, but I understand why it’s set up the way it is} I still think I made a wise choice. My senior year of college I was blessed with leading a small Bible study with my teammates, which really confirmed my purpose for picking that university.

About a year after I graduated college, a church women’s small group I attended did a study on idols. We talked about how an idol isn’t just a gold statue you worship, but it’s actually anything that distracts you from focusing on God. Money/debt – that was my idol. God really worked on me over the last 9 years to daily give up my worry for making and saving enough money and to trust Him to take care of me. He always has. He always will. Why still worry about money? I’m glad to say that I’ve really come a long way in defeating/removing my idol. Eugene’s really helped me in that too; he’s a good saver and a wise spender, but he doesn’t let money stress him out or take over his thoughts like I have in the past.

While God was working on me internally, I was working, working, working externally too. Each time I sat on those campus steps, I prayed through my tears that God would allow me to pay off my college loans way earlier than the typical 30 year life of loans. I prayed for wisdom in my financial decisions too. So how did He provide? It’s not rocket science, it’s tons of prayer and a lot of discipline & sacrifice.

- Pray. It’s a whole lot harder to go blow $100 on a dress if I just prayed for God to help me make wise decisions financially. It’s also a whole lot harder to quit my job to be a stay-at-home mom {which I’d love to do, and hopefully will someday soon}, when God provides a fantastic financial offer to work from home. Praying has been critical to seeing God work in our financial journey to becoming debt free.

- Pay God first. We tithe before paying any of our loans. It’s not my money anyway. I’m just giving God what’s His, and doing it first. He’s blessed us financially, and I can’t help but think that obeying Him by tithing pleases him.

- Work. I worked a lot, and I worked smart. Through college I managed to find time to work four paid internships {while volunteering for my scholarship requirements and playing a very demanding sport}, I also worked at the Writing Center and in our Athletic Department and coached Club volleyball. My internships led to a full-time job right out of college. I was laid off of that job, but through networking during my wedding planning, God provided another {better paying job} after that, and another {again, better paying position} after that through networking through my first internship/job. Same deal with Eugene…God provided one job after another, even when it seemed there was no open position out there for him.

- Stay focused.We both agreed paying off loans completely was our priority. We chose to pay each loan off either by the largest interest rate first, or if we had a small amount that we could afford at that time. Each time we paid one off, Eugene and I would have a sort of “business meeting” to talk through what we still owed and which loan we’d like to attack next. In the last year, we really got focused, paying over $38,000. Once you get momentum, it’s even easier to keep saving & paying ‘em off!

- Save every penny. This was easier before I got married, bought a house, and had a child, but it still definitely applies. All through college I didn’t spend money on going out to eat, Spring Break vacations, cute outfits, or even just the usual college expense of alcohol. {I didn’t drink in college for other reasons too, but it definitely saved me a ton of money to go with water!} I made my own lunches, bought cheap groceries, cancelled the automatic big meal plans, and I even stayed at home to commute my Junior year. {That sacrifice really sucked, but I didn’t really have a choice that year because of loan maxes and what not.}

Now, Eugene and I save by buying only used cars that we can afford to pay in full at the time of purchase. We bought a foreclosed house {one we could afford on just one income} and DIY’ed anything we could to save a buck. We have the lowest/cheapest internet and pay-as-you-go cell phones. We shop for groceries at Aldi {which is cheaper than coupons for me}, pack our lunches every day, and we rarely go out to eat – especially without a coupon or gift certificate. In our four years of marriage, we’ve gone on just two vacations: our honeymoon {which God gave us a tax return check that paid for the entire trip!} and our Florida vacation {which we stayed with friends and kept expenses super low.} We open our windows lots instead of running air, we don’t buy new clothes often and when we do it’s always clearance, we shop consignment sales for kid stuff and furniture to renovate. And we don’t EVER buy anything we can’t afford at that moment. No car loans or engagement ring loans for us! We also save for our retirement, taking full advantage of employer matches…that’s free money!

I don’t necessarily follow Dave Ramsey’s method, but I really like his catch phrase “Live like no one else, so that later you can live like no one else.” It’s right on. And honestly, I don’t feel like we’ve been living bad at all. I love our life style, and we’re perfectly comfortable!

I guess that’s the biggest set of tips I can give. Oh, and I think I’ll get a job at a university so my kids can go free! ;)

It’s so freeing to know that we’re out of debt, and that we’re aspiring to use the money God’s given us to bring him glory. Now that we don’t have to keep paying Sallie Mae, we can hopefully do that even more.

I’ve been waiting so long to say those three little words. Such a huge statement. A big proclamation to how awesome God is – my great provider! I’M DEBT FREE!

While this is such a huge moment for me, for us, I’d be remiss to not mention the even more significant debt that Christ paid for me. He has paid my sins. I am no longer a debtor to sin, but alive and free in Him. Thank God that I’m debt free in more ways than one! :) He is so good.

Thanks for sharing! This is something I struggle with daily.

ReplyDeleteWhat an accomplishment Caitlin! I wish I could proclaim the same. Your story is so inspiring, thanks for sharing :)

ReplyDeleteI just ran onto your blog yesterday as I was searching for methods to finish butcher block countertops. Today's post is very inspiring. I plan to read backwards in time through you blog. Thanks, Cheryl R.

ReplyDelete